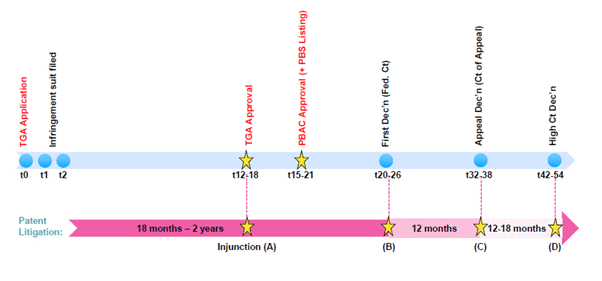

Figure 1: Typical regulatory review timeline with standard patent litigation overlay in Australia

3. Beware of preliminary discovery in Australia

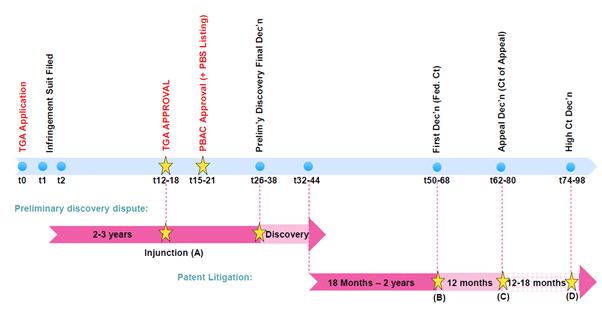

Preliminary discovery as a precursor to patent litigation has emerged as an effective tool to prevent generic/biosimilar market entry. When considering the strategic options available in response to such an application, applicants must be mindful of the lessons learned from the recent five-year (and counting) etanercept (Enbrel) Federal court preliminary discovery dispute (Pfizer Ireland Pharmaceuticals and Ors v Samsung Bioepis AU Pty, NSD2149/2016). Using a “typical” timeline, an application for preliminary discovery, followed by patent litigation, could result in judgment six to eight years after Therapeutic Goods Administration approval of the biosimilar/generic application, as shown in Figure 2.

Figure 2: Typical regulatory review timeline with preliminary discovery and standard patent litigation overlay in Australia

4. Beware of reforms regarding early disclosure

Further reforms are anticipated in Australia which will result in the originator receiving notification of the generic/biosimilar application shortly after the dossier is filed. This will alter the dynamics of patent litigation in Australia.

For applicants who have not taken steps to “clear the way”, the result will be the induced commencement of patent litigation by the patentee to shortly after filing the application, rather than on approval.

Naomi Pearce

CEO, Executive Lawyer (AU, NZ), Patent & Trade Mark Attorney (AU, NZ)

Naomi is the founder of Pearce IP, and is one of Australia’s leading IP practitioners. Naomi is a market leading, strategic, commercially astute, patent lawyer, patent attorney and trade mark attorney, with over 25 years’ experience, and a background in molecular biology/biochemistry. Ranked in virtually every notable legal directory, highly regarded by peers and clients, with a background in molecular biology, Naomi is renown for her successful and elegant IP/legal strategies.

Among other awards, Naomi is ranked in Chambers, IAM Patent 1000, IAM Strategy 300, is a MIP “Patent Star”, and is recognised as a WIPR Leader for patents and trade marks. Naomi is the 2023 Lawyers Weekly “IP Partner of the Year”, the 2022 Lexology client choice award recipient for Life Sciences, the 2022 Asia Pacific Women in Business Law “Patent Lawyer of the Year” and the 2021 Lawyers Weekly Women in Law SME “Partner of the Year”. Naomi is the founder of Pearce IP, which commenced in 2017 and won 2021 “IP Team of the Year” at the Australian Law Awards.